Don't Be Fooled by these Stall Tactics!!

Understanding Credit Bureau Stall Tactics: What You Need to Know

Today, we’re addressing an important topic: Stall Tactics employed by credit bureaus. These strategies are designed to delay the credit repair process and can often discourage individuals from pursuing their credit improvement efforts.

What Are Stall Tactics?

A "Stall Tactic" or "Stall Response" refers to the common practices used by credit bureaus to slow down your credit repair journey. Whether you see these tactics as frustrating or simply inefficient, their primary goal is to dissuade you from pursuing credit repair, as it ultimately costs them money.

These tactics can be confusing and overwhelming, especially for those unfamiliar with the process. However, it’s crucial to recognize them and not let them deter you!

Stall Tactics Are Common

While annoying, these tactics are a standard part of the credit repair process. Almost everyone involved in credit repair encounters them. Remember, the keys to overcoming these hurdles are pressure, persistence, and knowing your rights under the law!

The Fair Credit Reporting Act mandates that credit bureaus must send a written response to your dispute letters. This means that after submitting your initial disputes, you should expect responses from Equifax, Experian, and TransUnion. Each bureau has its own records, so responses may differ.

Bureaus have 30 days to respond, but it can take up to 45 days in some cases. If one or more bureaus fail to respond, don't worry—they are legally required to investigate and respond. A gentle reminder about their obligations can go a long way.

What to Expect in Responses

Typically, you will receive one of three types of responses:

Recognizing Stall Letters

It’s important to be able to identify these letters. They can take several forms:

Key Types of Stall Letters

The three primary types of stall letters are:

Stay Strong and Informed

While the communication pattern can feel like a monthly cycle of waiting, it’s essential to remain persistent. The bureaus aim to frustrate you, but you have the power to push back.

Remember, all correspondence from the bureaus is sent directly to you. If you receive a stall letter, please notify us immediately! Our responses to these stall tactics are also part of the process, and we will continue to apply pressure and stay persistent.

Together, we’ll navigate this process, and I’ll keep you updated every step of the way!

What Are Stall Tactics?

A "Stall Tactic" or "Stall Response" refers to the common practices used by credit bureaus to slow down your credit repair journey. Whether you see these tactics as frustrating or simply inefficient, their primary goal is to dissuade you from pursuing credit repair, as it ultimately costs them money.

These tactics can be confusing and overwhelming, especially for those unfamiliar with the process. However, it’s crucial to recognize them and not let them deter you!

Stall Tactics Are Common

While annoying, these tactics are a standard part of the credit repair process. Almost everyone involved in credit repair encounters them. Remember, the keys to overcoming these hurdles are pressure, persistence, and knowing your rights under the law!

The Fair Credit Reporting Act mandates that credit bureaus must send a written response to your dispute letters. This means that after submitting your initial disputes, you should expect responses from Equifax, Experian, and TransUnion. Each bureau has its own records, so responses may differ.

Bureaus have 30 days to respond, but it can take up to 45 days in some cases. If one or more bureaus fail to respond, don't worry—they are legally required to investigate and respond. A gentle reminder about their obligations can go a long way.

What to Expect in Responses

Typically, you will receive one of three types of responses:

- Investigation Results – This will inform you of any changes made to your report, which is a cause for celebration!

- Verification – If the disputed information is verified, you can challenge this outcome.

- Stall Letter – Unfortunately, many people encounter stall letters as a common first response.

Recognizing Stall Letters

It’s important to be able to identify these letters. They can take several forms:

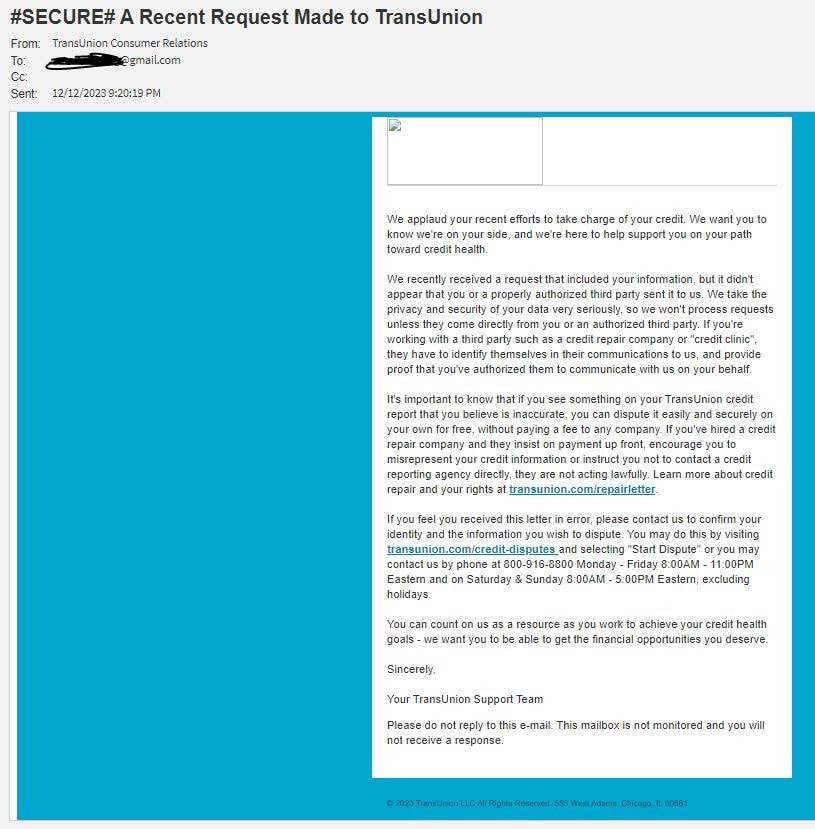

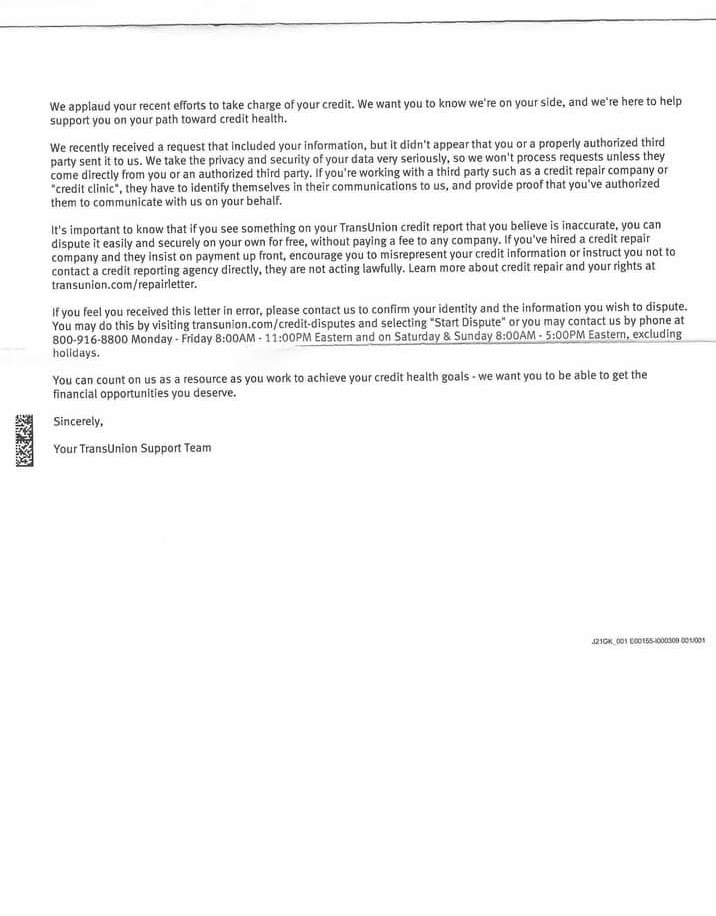

- Claims that your request is “suspicious.”

- Notices that your request is “frivolous” and won’t be investigated.

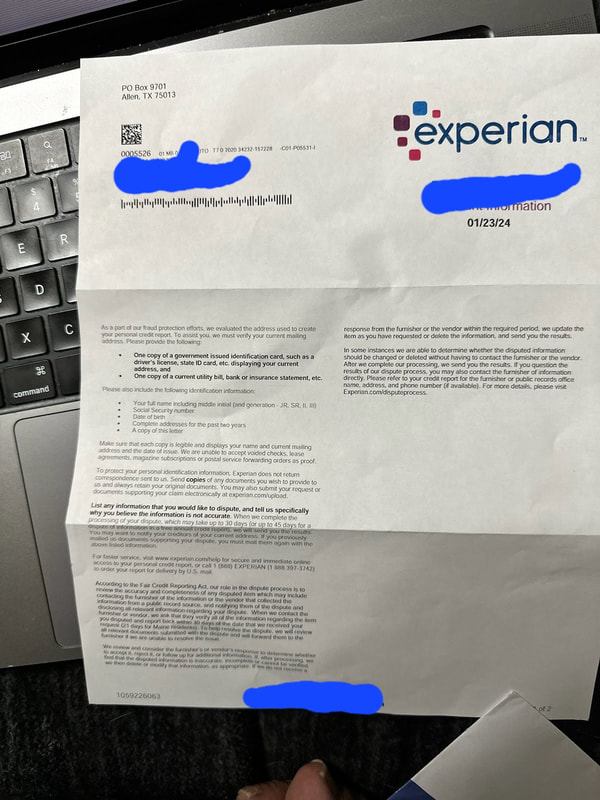

- Requests for additional documents to verify your identity.

- Assertions that your request was not legible.

Key Types of Stall Letters

The three primary types of stall letters are:

- Suspicious Request

- Frivolous Request

- Insufficient Identification

Stay Strong and Informed

While the communication pattern can feel like a monthly cycle of waiting, it’s essential to remain persistent. The bureaus aim to frustrate you, but you have the power to push back.

Remember, all correspondence from the bureaus is sent directly to you. If you receive a stall letter, please notify us immediately! Our responses to these stall tactics are also part of the process, and we will continue to apply pressure and stay persistent.

Together, we’ll navigate this process, and I’ll keep you updated every step of the way!

These people had amazing results

|

"The Credit Lady helped me fix my credit over 163 points! "

Callum R. |

"It feels so amazing to have confidence with getting approved thanks The Credit Lady for helping me out!"

Dave I. |

"5 stars it was challenging being a single mother of 4 thanks to fixing my credit we now own a home that is ours! "

Gloria G. |